Meta’s Stock Surges Over 8% Amid Robust Second-Quarter Earnings

The social media giant, parent company of Facebook and Instagram, saw its stock surge over 8% early on Thursday. The unexpected strength in the company’s second-quarter earnings sent waves of excitement among investors.

Strong Financial Performance

Meta reported a 22% year-over-year revenue increase to $39.07 billion, topping analysts’ expectations of $38.26 billion. This impressive performance was further highlighted by an earnings per share (EPS) of $5.16, representing a 73% year-over-year increase.

Future Projections

For the upcoming quarter, Meta projected revenue between $38.5 billion and $41 billion, while analysts had forecasted $39.1 billion. This forward-looking guidance gave investors confidence in the company’s continued growth trajectory.

Key Quotes from CEO Mark Zuckerberg

"We had a strong quarter, and Meta AI is on track to be the most used AI assistant in the world by the end of the year," said Meta CEO Mark Zuckerberg during his earnings call. "We’ve released the first frontier-level open source AI model, we continue to see good traction with our Ray-Ban Meta AI glasses, and we’re driving good growth across our apps."

Robust Advertising Business

The company’s advertising business remains a major driver of its revenue. Ad impressions and average price per ad increased by 10% year-over-year. Meta’s net income for the quarter was $13.47 billion, up 73% from the previous year.

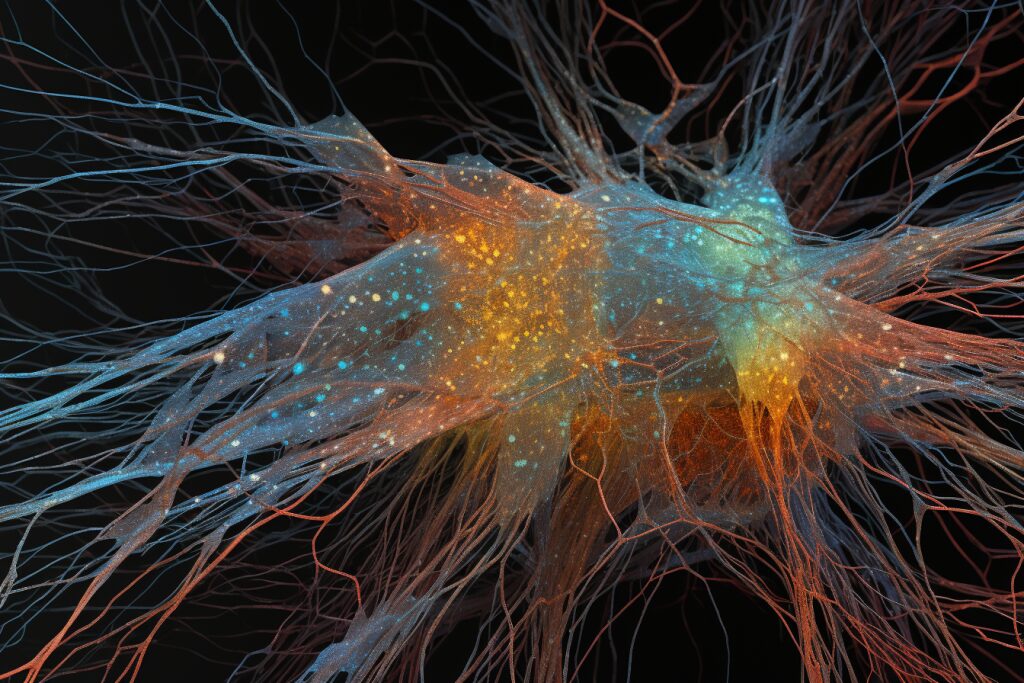

AI Investments and Market Reactions

Meta’s significant investments are focused on building datacenter capacity to support its AI ambitions. The company raised its 2024 capital expenditures forecast to $37 billion to $40 billion, up from the previous range of $35 billion to $40 billion. Chief Financial Officer Susan Li indicated further growth in capital expenditures for 2025 to support AI research and product development.

Costs Associated with AI Model Training

Investors are closely monitoring the substantial costs associated with AI model training and operations. Zuckerberg acknowledged the long-term nature of Meta’s AI vision but emphasized the importance of building capacity ahead of demand.

AI Enhancements and Advertising Automation

AI is already enhancing content recommendations on Facebook and Instagram. Zuckerberg envisions a future where advertisers can set business objectives and budgets, and Meta’s AI will handle the rest. "Over the long term, advertisers will basically just be able to tell us a business objective and a budget and we’re going to go do the rest for them," Zuckerberg explained.

Analysts’ Perspective

Analysts have responded positively to Meta’s earnings report and AI strategy. RBC analyst Brad Erickson highlighted Meta’s strong performance and justified elevated capital expenditures. Debra Aho Williamson, founder and chief analyst of Sonata Insights, noted Meta’s advantage due to its established revenue from digital advertising, differentiating it from other tech firms with AI ambitions.

Stock Market Impact

Despite the positive earnings report, Meta’s stock has been impacted by broader market factors. The company’s recent decline continues to weigh on its performance, though it remains a key player among the "Magnificent Seven" stocks.

Meta’s stock also faced pressure from Google’s lower-than-expected ad revenue for YouTube and a broader shift away from big tech stocks. Despite these challenges, Meta maintains a strong position with an IBD Composite Rating of 85 out of 99, reflecting solid performance metrics and technical strength.